Government accounting is responsible for managing and reporting on the government's finances. Government accounting serves two purposes: it provides information about cash availability and expenditures. It also maintains records on all manufacturing and trading activities and can calculate profits and losses. These are just a few of the many benefits of government accounting. These include: – Easy access to financial records, information – Financial statements that reflect government's financial condition.

- Lucrative salary and comprehensive benefits Package: A career in government accounting can bring competitive salaries and a slew of benefits. Many benefits are available, such as extensive health care, free transportation, student loan waivers, large retirement matching plans, and substantial pension plans. You can also expect to grow and advance, with a salary that can reach six figures. But what are the drawbacks? Government accounting might be for you if you are passionate about accounting.

- Government accounting allows government officials understand and plan effectively the budget. Governments can make better decisions about where they allocate resources. They can also track the value government assets and cash flows with government accounting. It is critical for planning the national economy. You should also be aware of the importance government accounting.

- Realizeable accounting: The community owns the government assets. They should be noted in the government's books. With the advent of modern government functions and an increase in assets, there has been an increase in the number of government functions. For transparency, government accounting should reflect these assets. It should be more comprehensive than its predecessors. Government accounting must show the assets and liabilities of a government. For example, it should reflect all assets held by the government.

- Government jobs: The position requires a good aptitude in mathematics and a desire to help the government. Government accountants are often required to audit individuals and companies. The ability to use mathematics, analyze financial records and communicate well are essential for government accountants. You can get a job as an accounting professional at either the state or federal level with a bachelor's in accounting.

- Accountability & transparency: Government accounting ensures fair funding distributions among different programs, activities, and separate funds for diverse activities. In addition, government accounting provides transparency in government budgets, as it clarifies how resources are distributed across different programs. For almost every government entity, government accounting is crucial. With the ability to track and analyze government resources, you can better manage and improve the way they are used in your organization. Your job will be easier and transparent if your knowledge is broadened in the area of government accounting.

Financial reporting and accountability are essential parts of government accounting. A clear understanding of how numbers affect government operations is the first step towards ensuring that numbers are what you believe they are. Knowing the difference between actual and projected expenditures will make it easier to manage your budget. There are two main types of accounting: accrual-based and cash-based. In both cases, the difference between the two is reported as the net value of the organization.

FAQ

What is the distinction between a CPA & Chartered Accountant, and how can you tell?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants have more experience than CPAs.

Chartered accountants are also qualified to offer tax advice.

The average time to complete a chartered accountancy program is 6-8 years.

What is the difference between bookkeeping and accounting?

Accounting refers to the study of financial transactions. The recording of these transactions is called bookkeeping.

These are two related activities, but separate.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They adjust entries in accounts payable, receivable, and payroll to ensure that all books are balanced.

Accountants analyze financial statements to determine whether they comply with generally accepted accounting principles (GAAP).

If they are unsure, they might recommend changes in GAAP.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

What is the purpose and function of accounting?

Accounting gives a snapshot of financial performance through the recording, analysis, reporting, and recording of transactions between parties. It allows organizations to make informed financial decisions, such as whether to invest more money, how much income they will earn, and whether to raise additional capital.

Accounting professionals record transactions to provide financial information.

This data allows the organization plan for its future business strategy.

It's essential that the data is accurate and reliable.

What happens if my bank statement isn't reconciled?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

At that point, you'll have to go through the entire process again.

How long does an accountant take?

Passing the CPA exam is required to become an accountant. Most people who wish to become accountants study for around 4 years before taking the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

Are accountants paid?

Yes, accountants can be paid hourly.

Complex financial statements may be prepared by accountants who charge additional.

Sometimes accountants can be hired to do specific tasks. An accountant could be hired by a PR firm to prepare a report describing the client's performance.

How Do I Know If My Company Needs An Accountant?

Companies often hire accountants once they reach certain sizes. A company may need an accountant if it has more than $10 million in annual sales.

However, there are some companies that hire accountants regardless if they have a small business. This includes small businesses, sole proprietorships and partnerships as well as corporations.

It doesn't really matter how big a company is. Only important is the use of accounting systems.

If it does, the company will need an accountant. If it doesn’t, then it shouldn’t.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

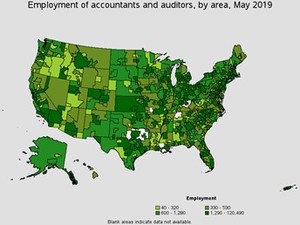

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to be an Accountant

Accounting is the science and art of recording financial transactions and analyzing them. It also involves the preparation of reports and statements for various purposes.

A Certified Public Accountant (CPA) is someone who has passed the CPA exam and holds a license issued by the state board of accountancy.

An Accredited Finance Analyst (AFA), an individual who meets certain requirements established by the American Association of Individual Investors. A minimum of five year's investment experience is required before an individual can be made an AFA. They must pass a series exam to verify their understanding of accounting principles.

A Chartered Professional Accountant is also known by the name chartered accountant. This is a professional accountant who received a degree at a recognized university. CPAs must comply with the Institute of Chartered Accountants of England & Wales’ (ICAEW) educational standards.

A Certified Management Accountant (CMA), is a certified professional accountant that specializes in management accounting. CMAs must pass exams administered annually by the ICAEW. They also need to continue continuing education throughout their careers.

A Certified General Accountant is a member of American Institute of Certified Public Accountants. CGAs must pass multiple exams. One of these tests, the Uniform Certification Examination or (UCE), is required.

A Certified Information Systems Auditor (CIA) is a certification offered by the International Society of Cost Estimators (ISCES). Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs are required to hold a baccalaureate degree in finance, business administration, economics, or public policy and must pass two written exams and one oral exam.

The National Association of State Boards of Accountancy offers the certification of Certified Fraud Examiners (CFE). Candidates must pass at least three exams to be certified fraud examiners (CFE).

International Federation of Accountants is accredited a Certified Internal Audior (CIA). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

American Academy of Forensic Sciences, (AAFS), gives the designation of Associate in Forensic accounting (AFE). AFEs must have graduated from an accredited college or university with a bachelor's degree in any field of study other than accounting.

What is the job of an auditor? Auditors are professionals who audit financial reporting and internal controls of an organization. Audits can be conducted randomly or based upon complaints from regulators regarding the organization's financial reports.