In Atlanta, Georgia, a junior accountant earns approximately $75,000 per year. The salary varies depending on where you live and what certifications and skills you have. Continue reading to learn more about this position's average salary. The following are additional facts and information about the job. Read on to discover more about the salary of a junior accountant. Here are some tips to help you get started on your job search.

Cities with the highest salaries

Commack in New York is the top-paying city for junior accountants. Cherry Hill NJ and San Francisco are the next most lucrative cities for junior accountants. These cities average $36,000 annually, with the lowest-paid junior accountants earning below $30K. Professional services is the highest-paying industry for junior accountants, followed closely by manufacturing. These cities have a high economic potential and offer competitive salaries.

The salary of an accounting professional varies depending on where you live, what specialty you are in, and which employer you work for. Computer and peripheral equipment manufacturing are some of the most lucrative industries for accountants. Many accountants work full-time, and are busier during tax season than during the budget year. Listed below are the top paying cities for junior accountants. It is rewarding to be an accountant.

Average salary

The average salary of a junior accounting professional varies greatly depending on the region and company. Wedbush Securities, Realty Income and Realty Income are the highest-paid firms for junior accountants. Zippia offers salary reports that can help you figure out if your job is paying the right amount. The average salary for junior accountants is not guaranteed. However, you can always request a raise depending on your performance. The salary of a junior accountant may also be higher or lower than the national average.

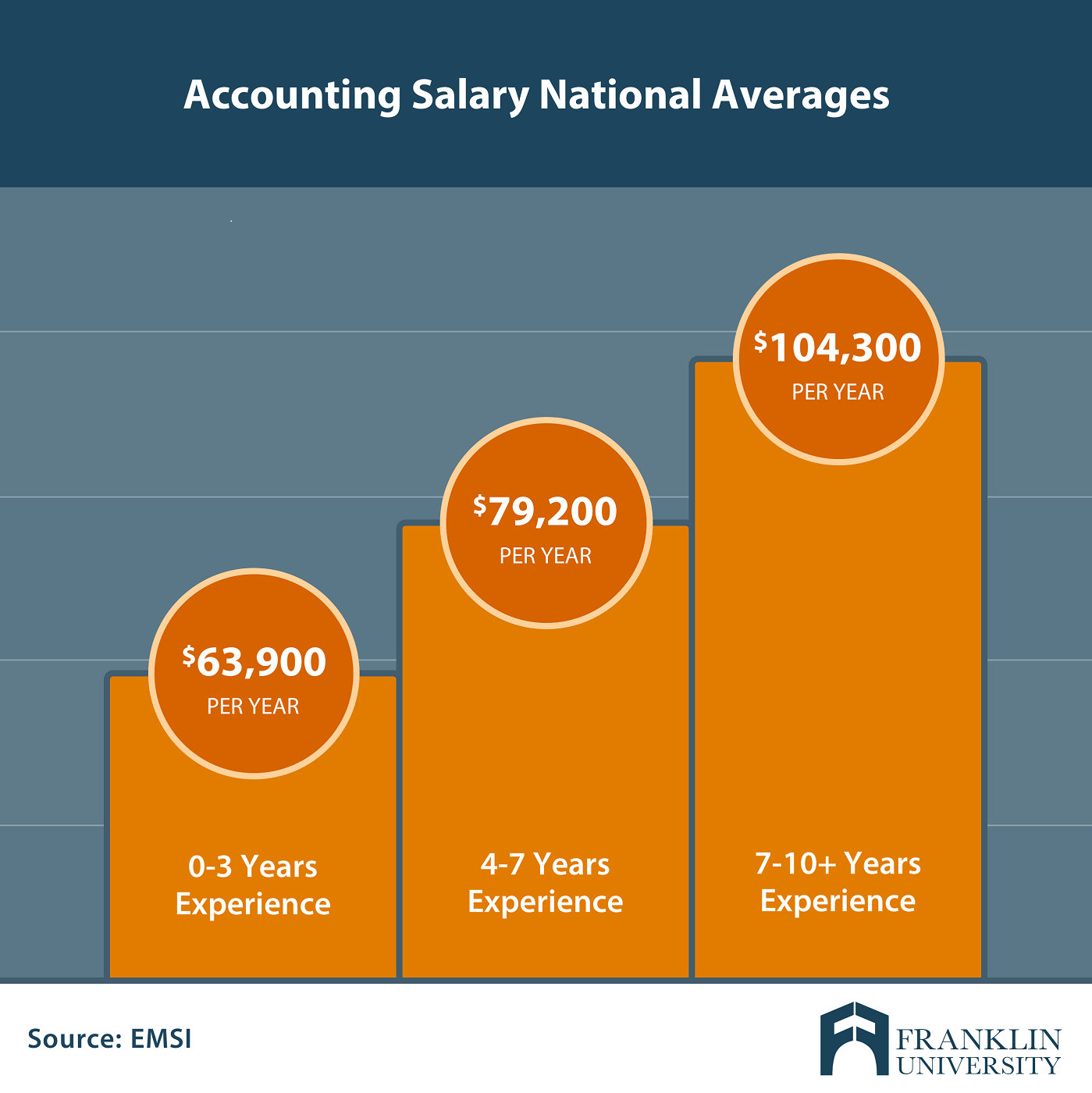

The average annual salary for a junior accountant in the US is $61,057, with an average $3,000 bonus. This bonus makes up about 5% their total compensation. 100 percent of junior accountants claim to have received a Bonus. The average salary for a US career is 17% more than this compensation. The salary of a junior accountant may vary for many reasons. A great deal of it depends on the company, the position, and the company.

Required skills

You will need certain skills to be a successful junior accountant. You must be able to analyse data. As your job involves reviewing a lot financial records and other files, you will need to be extremely detail-oriented. Your analytical skills are essential to find discrepancies, rectify mistakes and perform other tasks efficiently.

Next, math skills are essential. Junior accountants need to be proficient in mathematics as it is the foundation for all other positions within the field. It is also necessary to understand how to manipulate numbers. By learning this skill, you will be able to understand what is causing you problems and how to solve them. You will also need time management skills to succeed in this job.

Job description

A junior accountant's salary can vary significantly depending on the position. Employers value the skills you have as a junior accountant. Here are the top skills employers seek in a junior accountant. These skills can be found in percentages, depending on the job posting. You can also compare salaries for similar job titles like accountant. It is possible to compare the salaries of similar job titles, such as accountant.

An accountant junior is often hired for work in the public service sector, mostly in assurance and audit services. This job usually involves managing the general ledger as well as overseeing daily financial transactions. Other duties include auditing fixed assets and matching large batches of invoices. Junior accountants maintain accuracy in employee timesheets. Their salaries are often based upon the 7th pay Commission pay scale. For the first two years, they earn approximately $23,300 GEL.

FAQ

Are accountants paid?

Yes, accountants often get paid hourly.

Some accountants charge extra for preparing complicated financial statements.

Sometimes accountants may be hired to perform specific tasks. An example of this is a public relations firm that might hire an accountant for a report on how the client is doing.

What is the difference between a CPA (Chartered Accountant) and a CPA (Chartered Accountant)?

Chartered accountants are certified accountants who have successfully completed the exams necessary to become chartered. Chartered accountants are usually more experienced than CPAs.

Chartered accountants are also qualified to offer tax advice.

To complete a chartered accountant course, it takes about 6 years.

What happens if I don't reconcile my bank statement?

It's possible that you won't realize it until the end if your bank statement isn't in order.

At this point, you will need repeat the entire process.

What is an Audit?

An audit involves a review and analysis of a company's financial statements. Auditors examine the company's books to verify everything is correct.

Auditors are looking for discrepancies among what was reported and actually occurred.

They also ensure that financial statements have been prepared correctly.

Why is reconciliation so important?

It's very important because you never know when mistakes happen. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have grave consequences, including incorrect financial statements or missed deadlines, overspending and bankruptcy.

What do I need to start keeping books?

A few items are necessary to start keeping books. You will need a notebook, pencils and calculators, a printer, stapler, pen, stapler, envelopes and stamps, as well as a filing cabinet or drawer.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

External Links

How To

Accounting for Small Businesses: How to Do It

Accounting is an essential part of managing any business. This task includes keeping track of income and expenses, preparing financial reports, and paying taxes. This task also requires the use of software programs, such as Quickbooks Online. There are several ways to do small business accounting. You need to choose the most appropriate method for your business. Below we have listed some of the top methods for you to consider.

-

Use the paper accounting method. Paper accounting is a good option if you prefer simplicity. The process of using this method is very easy; you just need to record your transactions daily. If you are looking to ensure that your records are accurate and complete, you may want to consider QuickBooks Online.

-

Use online accounting. Online accounting gives you the ability to easily access your accounts whenever and wherever you are. Wave Systems, Freshbooks, Xero, and Freshbooks are just a few of the popular options. These software allows you to manage your finances and generate reports. They offer great features and benefits, and they are easy to use. So if you want to save time and money when it comes to accounting, you should definitely try out these programs.

-

Use cloud accounting. Another option is cloud accounting. It allows you secure storage of your data on a remote server. Cloud accounting is a better option than traditional accounting systems. It doesn't require you to purchase expensive hardware or software. Because all your information is stored remotely, it provides better security. Third, it saves you from worrying about backing up your data. Fourth, you can share your files with others.

-

Use bookkeeping software. Bookkeeping software works in the same way as cloud accounting. However, you will need to buy a computer to install the software. After the software has been installed, you can connect to your internet account to access them whenever you like. You will also have the ability to access your accounts and balances directly from your PC.

-

Use spreadsheets. Spreadsheets allow you to enter your financial transactions manually. To illustrate, you could create a spreadsheet in which you can record your sales figures daily. You can also make changes whenever you like without needing to update the whole document.

-

Use a cash book. A cashbook lets you keep track of every transaction. There are many different shapes and sizes of cashbooks depending on how much room you have. You can choose to use separate notebooks for each months or one notebook that spans multiple years.

-

Use a check register. You can use a check register as a tool to help you organize receipts or payments. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. Notes can be added to the items once they are scanned.

-

Use a journal. You can keep track of all your expenses by using a journal. If you have many recurring expenses, such as rent, insurance, or utilities, this journal is the best.

-

Use a diary. You can simply use a diary to keep track of your life. You can use it for tracking your spending habits or planning your budget.