If you have a degree in accounting, or are interested in becoming a full charge bookkeeper, there are several factors you should consider. These factors include education requirements, salary, job duties, and training requirements. You may even be able to get a job as a full charge bookkeeper without a degree. This article will give background information that can help you decide if this is the right career path for you.

Job outlook

The job description of a bookkeeper with full-time charge will change as the field of accounting changes. The job description will change as accounting software and computer technology improve. In small business offices, however, the position of the full-time bookkeeper will not change. The field is expected to experience declines in demand in the years to come. The prospects for this profession are good right now. Candidates who are skilled in accounting and have an interest numbers and data will have the best chance of succeeding.

Salary

You can start your career in an assistant bookkeeper if you are interested in becoming a full-time bookkeeper. This position requires a bachelor’s degree. It is best suited for businesses that deal with simple accounting transactions. The job description for a full-charge bookkeeper could change as accounting programming and computer technology improve. There is always opportunity for advancement but a full-charge bookkeeper will always be a part of small businesses.

Education is required

The education requirements for full-time bookkeepers vary depending on the company. Although certification may be an option, associate's degrees or bachelor's degrees in accounting are required for most jobs. A full charge bookkeeper must be well versed in accounting principles, double-entry bookkeeping, and various accounting programs and procedures, including chart of accounts and journal entries. They must be able present and prepare financial statements, prepare tax returns, as well as understand accounting software.

Job duties

Full-time bookkeepers are responsible for preparing income statements and balance sheets each month. These statements will be prepared after all books have been closed. Sometimes, owners and managers may request periodic reports to make sure that the company's finances are in line with their expectations. Full charge bookkeepers may also supervise other employees.

Salary range

Prices for bookkeepers at full charge vary widely depending on the location, experience and certifications. In general, however, the highest-paid bookkeepers earn $50,631 each year. Despite the wide range of salaries, the average full-time bookkeeper salary is much higher than the national average. In order to determine a realistic salary range, it is important that you consider your local cost of life. If you're thinking about moving to another state to get a better job, here's what to expect.

FAQ

How much do accountants make?

Yes, accountants can be paid hourly.

Accounting firms may charge an additional fee to prepare complex financial statements.

Sometimes accountants will be hired to complete specific tasks. An accountant might be hired by a public relations company to create a report that shows how their client is doing.

What do I need to start keeping books?

To start keeping books, you will need some things. These items include a notebook and pencils, calculator, staplers, envelopes, stamps and a filing drawer or desk drawer.

How long does it usually take to become a certified accountant?

The CPA exam is necessary to become an accountant. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the test, one has to work for at least 3 years as an associate before becoming a certified public accountant (CPA).

What happens if I don’t reconcile my bank statements?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

Then, you will need to start all over again.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to do bookkeeping

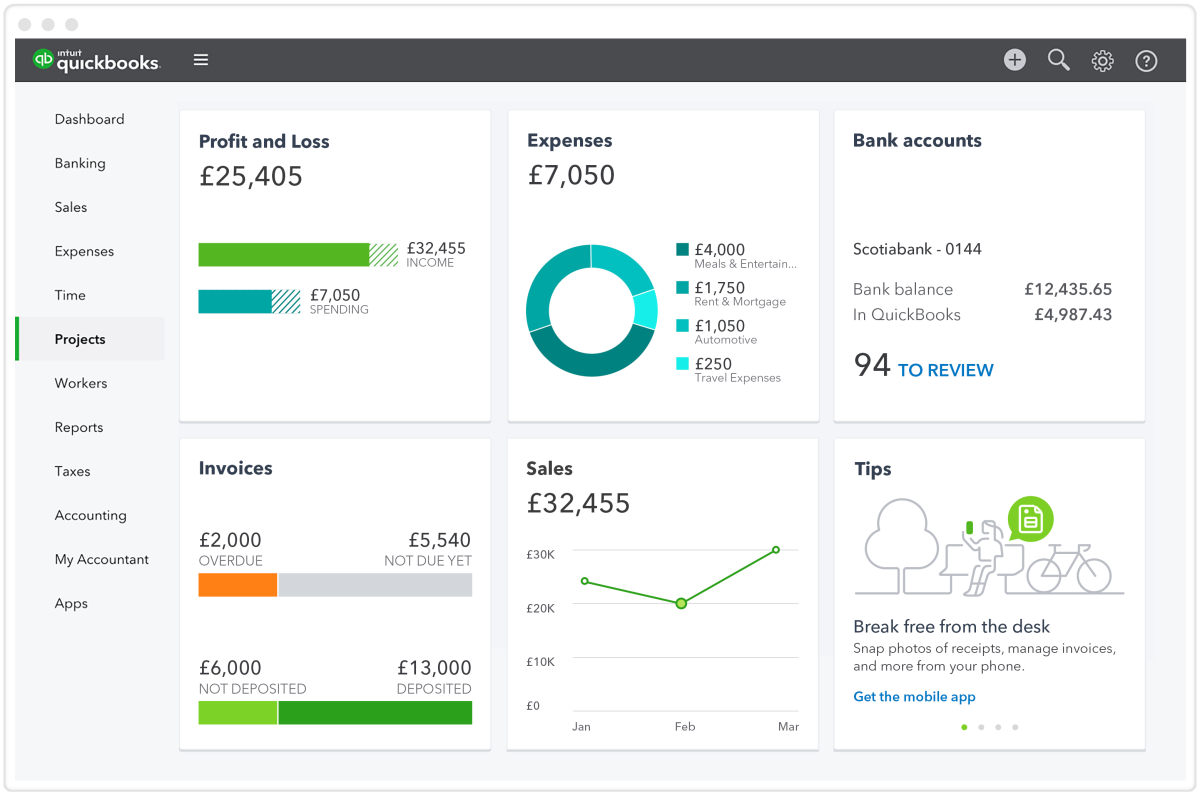

There are many kinds of accounting software. While some are free and others cost money, most accounting software offers basic features like invoicing, billing inventory management, payroll processing and point-of-sale. The following list provides a brief description of some of the most common types of accounting packages.

Free Accounting Software: Free accounting software is usually offered for personal use only. Although the software may be limited in functionality, such as not being able to create your own reports, it is very easy to use. If you are interested in analyzing your business' numbers, many programs allow you to directly download data to spreadsheets.

Paid accounting software: Paid accounts can be used by businesses with multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. Many companies offer subscriptions with a shorter duration than six months, but most paid programs require a minimum subscription of at least one year.

Cloud Accounting Software. Cloud accounting software allows for remote access to your files using any mobile device such as smartphones and tablets. This program has been growing in popularity because it reduces clutter and saves space on your computer's hard drive. No additional software is required. All that is required to access cloud storage services is an Internet connection.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Desktop software works in the same way as cloud software. It allows you to access files from any location, including via mobile devices. However, unlike cloud software, you must install the software on your computer before you can use it.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These apps allow you to manage your finances on the move. Typically, they provide fewer functions than full-fledged desktop programs, but they're still valuable for people who spend a lot of time traveling or running errands.

Online Accounting Software - Online accounting software was created primarily to serve small businesses. It offers all the functionality of a desktop program, plus some extra features. Online software has one advantage: it doesn't require installation. Simply log on to the site and begin using the program. Another benefit is that you'll save money by avoiding the costs associated with a local office.