Online accounting certifications are a great way for you to get into the financial industry. You can use this certificate to prepare for the state CPA exam. Earning a certificate can increase your job prospects, even if you already have a bachelor's in another field. Here are the benefits of earning your certificate online. We hope that this article helps you make the right choice. Be sure to do your research before you sign up for an online program.

Online accounting certifications are a great way to get into financial work.

Although a certificate in accounting program may seem costly, it can often be cheaper than a full college education. Financial aid programs can be used to pay for your education if you are eligible. To get access to state and federal financial aid programs, fill out the Free Application for Federal Student Aid. Students may qualify for grants or loans to cover tuition costs. Private student loans have higher interest rates than government loans. You can apply for scholarships through your college's financial aid office. Others are offered by philanthropic organizations and industry associations.

While earning a certificate in accounting is a great career path, many aspiring students choose to earn it online in order to balance their busy lives and keep their families happy. Online classes offered by accredited schools are flexible and can be accommodated around work and family responsibilities. The best online accounting certificate programs let students study when it suits them, and are affordable to make your life easier.

Online earning an accounting certificate is a great way to prepare for the state CPA examination

For candidates to be eligible for the CPA exam, several states have adopted the 150-college hour rule. This requirement allows non-accounting majors to fulfill accounting requirements by completing classes. Non-accounting majors in certain states can also use credits at lower levels earned by non-traditional methods. It is therefore important to carefully choose your courses.

While some states require accounting students to have a bachelor's level, others require advanced degrees. Graduate degree candidates have twice their pass rate than those without a master's degree. Non-AACSB universities require a grade at least B. Each state requires that candidates take the Uniform CPA Examination, as well as a professional ethics examination. Each state may have its own requirements, but there are some common features to each exam.

It is important to have a master's degree in accounting, but that does not mean you will be able to gain valuable experience. During your college years, you can take undergraduate or graduate business courses to get valuable experience in accounting. Check the accreditation standards for each school to make sure they are recognized by the state. Other important factors to consider are accreditation standards and number of programs.

An online accounting certificate can be a great supplement to a bachelor's program.

Online accounting certificates are a great alternative to getting a bachelor's. These certificates can often be earned for less than a full college diploma, and they are affordable if students look into financial aid. Generally, the government will offer financial aid to students. Many students qualify for government loans with lower interest rates. Students who are qualified can also receive government grants. Students may be eligible for accelerated certificate programs that require fewer classes. Many schools offer flexible programs and part-time classes to working students.

For working professionals who are looking for entry-level positions in accounting, the online undergraduate accounting certificate program of SNHU is a great choice. It is designed to prepare students for CPA exam preparation, promotion, or transfer. It can be used in conjunction with a bachelor's or master's degree. While these programs are not as rigorous as bachelor's degree programs, many students find them to be beneficial.

This increases your chances of landing a job

Earning an Accounting certificate online can be a great way to advance in your career. Your professional skills can be enhanced and you will have more networking opportunities. You can attend seminars, mixers, and professional organizations that cater to accountants, such as the American Institute of Certified Public Accountants and the Institute of Management Accountants. These associations can help you establish connections with colleagues, professors, and classmates that you can use even after you graduate. These connections can help you continue to improve your skills and knowledge all through your career.

An accounting certificate can be a great way to boost your resume if you already have an associate's level degree. A bachelor's degree is most commonly used to fill entry-level jobs, but an accounting certificate can give you the skills that you need in order to grow your career. Many accounting certificate programs are eligible for an associate's degree. Although they are different, the associate's degree will offer both general education and career-ready skills courses.

FAQ

What is the difference between accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. Bookkeeping is the documentation of such transactions.

They are both related, but different activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

They might recommend changes to GAAP, if not.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

What should I expect from an accountant when I hire them?

Ask questions about experience, qualifications and references before hiring an accountant.

You need someone who has done it before and is familiar with the process.

Ask them if they have any knowledge or skills that might be useful to you.

Look for people who are trustworthy in your community.

Why is reconciliation important?

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can cause serious consequences, including inaccurate financial statements, missed deadlines, overspending, and bankruptcy.

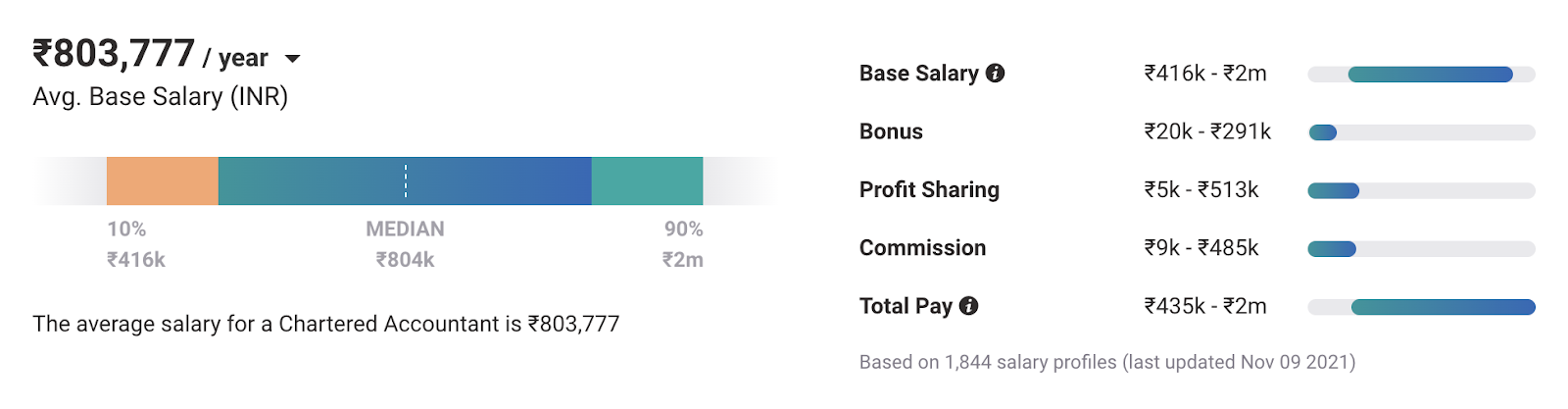

How much do accountants make?

Yes, accountants are often paid an hourly rate.

For complex financial statements, some accountants may charge more.

Sometimes accountants are hired to perform specific tasks. An accountant could be hired by a PR firm to prepare a report describing the client's performance.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

External Links

How To

How to Become an Accountant

Accounting is the science behind recording transactions and analysing financial data. Accounting can also include the preparation of reports or statements for various purposes.

A Certified Public Accountant is someone who has passed and been licensed by the state board.

An Accredited Financial Analyst (AFA), is someone who has met certain criteria set by the American Association of Individual Investors. A minimum of five year's investment experience is required before an individual can be made an AFA. A series of exams is required to assess their knowledge of securities analysis and accounting principles.

A Chartered Professional Accountant (CPA), also known as a chartered accounting, is a professional accountant with a degree from a recognized university. CPAs need to meet the specific educational standards set forth by the Institute of Chartered Accountants of England & Wales.

A Certified Management Accountant (CMA) is a certified professional accountant specializing in management accounting. CMAs must pass exams administered by the ICAEW and maintain continuing education requirements throughout their career.

A Certified General Accountant is a member of American Institute of Certified Public Accountants. CGAs have to pass several tests. One test is known as the Uniform Certification Examination.

International Society of Cost Estimators, (ISCES), offers the Certified Information Systems Auditor (CIA), a certification. CIA candidates must complete three levels of study consisting of coursework, practical training, and a final examination.

Accredited Corporate Compliance officer (ACCO) is a distinction granted by the ACCO Foundation, and the International Organization of Securities Commissions. ACOs must have a baccalaureate in finance, business administration or public policy. They also need to pass two written and one oral exams.

The National Association of State Boards of Accountancy offers the certification of Certified Fraud Examiners (CFE). Candidates must pass 3 exams and score a minimum of 70 percent.

A Certified Internal Auditor (CIA) is accredited by the International Federation of Accountants (IFAC). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

American Academy of Forensic Sciences gives Associate in Forensic Accounting (AFE), a designation. AFEs need to have graduated from an accredited college/university with a bachelor's level in any other field than accounting.

What does an auditor do exactly? Auditors are professionals that audit organizations' financial reporting. Audits can be performed on either a random basis or based on complaints received by regulators about the organization's financial statements.