After you have completed the CPA exams and gained the work experience required, you will be able to become a CPA. After you pass the exam, you will have to take the ethics exam. This process requires two forms: a Form 4B from your employer and a Form 2 from a foreign institution. You will also need to complete Form 2 if you have taken the CPA exam overseas.

After passing the Uniform CPA Exam you can apply for a CPA license

It's an exciting achievement to pass the Uniform CPA Exam, but it does not necessarily mean that you'll be awarded a license. Before applying for a license, you will need to satisfy a few education requirements. You can call yourself a CPA while you wait and mention that you passed the exam on your resume.

New York State recognizes Uniform CPA Exam. It is graded and prepared by the American Institute of Certified Public Accountants. CPA Examination Services, a division of the National Association of State Boards of Accountancy, administers the exam. The minimum score required to pass the exam is 75 for each of its four sections. Applicants must pass all parts of the exam within an eighteen-month window. They can however sit for the individual parts in each quarter.

New York State has a testing center located in New York City. After receiving their NTS, applicants must schedule their exam within six month. Not all applicants will be able to take the exam. Failure to arrive on time could result in the applicant losing their CPA licence fees.

CPA review courses

You can take a CPA Review Course without a degree in Accounting if your goal is to be an accountant. But, CPA review courses are not meant to replace intensive study. While a review course may help you prepare for the exam, effective study strategies are the key to success.

You must complete at least 15 semesters of accounting coursework, two years experience in public accounting and 4,000 hours of experience in audit compilation to be a CPA. If you already hold an accounting job, however, you may be able to take the exam without a degree. Maine and some other states have a more relaxed approach to what qualifies as work experience. Part-time employment in these states is permissible, so long as it's under the supervision CPA.

Although the idea of taking a CPA exam review course without having a CPA diploma may seem daunting, it can be done if you're determined to pass. New York law requires you to complete 120 semesters of course work, and to take at least one course in each area of accounting. Your New York license won't be issued if you do not.

Taking the ethics exam after taking the CPA exam

You will need to pass the ethics exam if you want to work in public accounting. This exam is required in most states. This exam is simple to pass, and it counts towards your CPE requirements. Many resources are available online to assist you in your preparation. Many state societies also offer study materials.

Although you can take the ethics test at any time during CPA licensure, most candidates will wait until they have passed the four sections. It is best to check the rules in your state to ensure that you are taking the exam at the right time.

A passing score on the AICPA ethics test is necessary to pass it. To do this, make sure you carefully read through the questions. You should not choose the first answer that pops into your head when taking the AICPA ethics test. To avoid any errors, you should carefully read through the options. An AICPA employee can help you if you have any questions about the answer choices.

FAQ

What happens if I don't reconcile my bank statement?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

This will force you to go over the entire process all over again.

What is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It includes recording all business-related expenses and income.

Bookkeepers track all financial information such as receipts, invoices, bills, payments, deposits, interest earned on investments, etc. They also prepare tax reports and other reports.

What is the purpose of accounting?

Accounting gives an overview of financial performance. It measures, records, analyzes, analyses, and reports transactions between parties. It allows organizations to make informed financial decisions, such as whether to invest more money, how much income they will earn, and whether to raise additional capital.

Accountants keep track of transactions to provide information about financial activities.

The data collected allows the organization to plan its future business strategy and budget.

It is important that the data you provide be accurate and reliable.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

Accounting for Small Businesses: What to Do

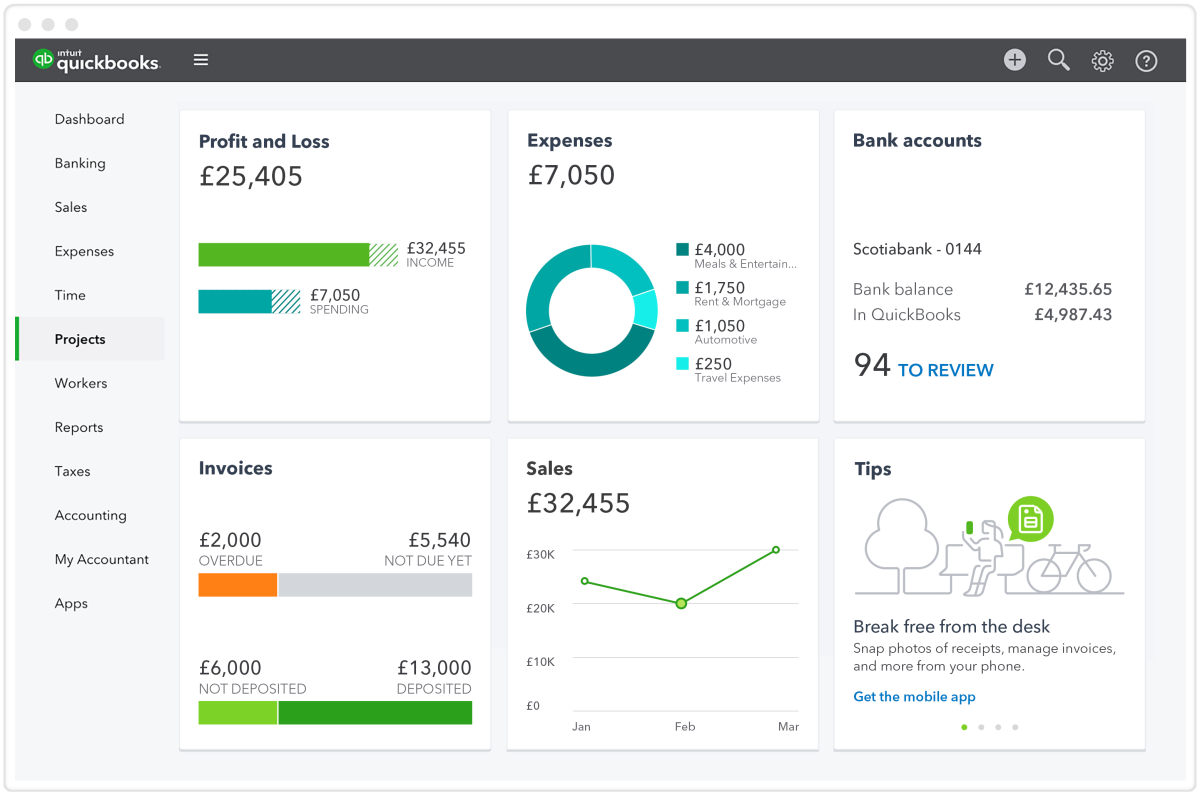

Accounting for small businesses should be one of your most important tasks when managing a business. Accounting involves keeping track of income, expenses, creating financial reports and paying taxes. Quickbooks Online is one of the software programs that can be used. There are several ways to do small business accounting. You should choose the best way for you according to your needs. Here are some top options that you can consider.

-

You can use paper accounting. You may prefer paper accounting if you are looking for simplicity. This method is very simple. All you need to do is keep track of all transactions. If you are looking to ensure that your records are accurate and complete, you may want to consider QuickBooks Online.

-

Online accounting is a great option. Using online accounting means that you can easily access your accounts at any time and anywhere. Wave Systems, Freshbooks and Xero are all popular choices. These software can be used to manage your finances, pay bills and send invoices. You can also generate reports. They are easy to use, have great features, and many benefits. These programs are a great way to save time and cash on your accounting.

-

Use cloud accounting. Cloud accounting is another option. It allows you secure storage of your data on a remote server. When compared to traditional accounting systems, cloud accounting has several advantages. Cloud accounting doesn't require expensive hardware and software. It offers greater security as all of your data is stored remotely. Third, it saves you from worrying about backing up your data. Fourth, it makes it easier for you to share your files with other people.

-

Use bookkeeping software. Bookkeeping software is similar to cloud accounting, but it requires you to purchase a computer and install the software on it. After installing the software, you will be able to connect to the internet so that you can access your accounts whenever you want. You can also view your balances and accounts right from your computer.

-

Use spreadsheets. Spreadsheets enable you to manually enter your financial transactions. You can, for example, create a spreadsheet that allows you to enter sales figures each day. You can also make changes whenever you like without needing to update the whole document.

-

Use a cash book. A cashbook lets you keep track of every transaction. There are many different shapes and sizes of cashbooks depending on how much room you have. You can choose to use separate notebooks for each months or one notebook that spans multiple years.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. To transfer items to your check list, all you have to do is scan them in your scanner. To help you remember what was bought, you can make notes once you have scanned the items.

-

Use a journal. A journal is a type logbook that tracks your expenses. If you have many recurring expenses, such as rent, insurance, or utilities, this journal is the best.

-

Use a diary. Keep a journal. You can use it as a way to keep track and plan your spending habits.