A personal accountant is a person you can hire to help you manage your finances. They can help record transactions, prepare financial statements, as well as prepare tax returns. This will allow you to avoid penalties. To plan for your future financial well-being, you can also consult a personal accounting firm. Here are some of these benefits:

Tax preparation

Here are some things you should know if you are considering hiring a professional accountant to prepare taxes. First, they need to stay abreast of changes in tax law. The IRS constantly updates the tax code and makes technical corrections. Most preparers spend hours every day looking for new changes. They also have to keep up with changes in state and local tax laws. The IRS website is a good place to start if you want to know about the most recent changes.

To get the most from your tax preparation, it is important to have identification. This is especially important when you plan to use refund anticipation loans. Your preparer should keep a copy of your ID on file. A copy of your Social Security cards is required. Any errors exceeding one digit may result in the rejection of your return and delay of refund.

Bookkeeping

Bookkeeping is an important part of the job of personal accountants. Bookkeeping is the process of recording income and expenses for a company, keeping track of receipts, and creating financial statements for clients. Bookkeepers are responsible for processing payroll returns and helping with tax returns. They may also prepare invoices for clients and make payments.

Many bookkeepers are only qualified with a high school diploma. There are however organizations that can offer additional certifications. Some bookkeepers can become Certified Public Bookkeepers, which requires continuing education and certification. The type of service and experience will determine the fee range. In most cases, bookkeepers are paid per hour, although prices can range as much as $30 per hour.

Payroll

Accounting for taxes is incomplete without proper payroll. Although most people are familiar enough with the annual personal income tax return, businesses often need to prepare several pay cycles per month. Each pay cycle requires calculations and tax payments. These payments need to be reported to IRS once per quarter. Payroll software can help you with this task.

Payroll systems use both liability and expense accounts to record employee wages. A liability is money you owe others, while an expense is money you spend on running a business. Unpaid expenses become a liability. In this example, premiums for workers' comp are an expense. If they are not paid, however, they become a liability.

Financial planning

Your financial planning could be enhanced by the help of a financial advisor or personal accountant. They can help create a budget and avoid impulse spending to save you money. They can also give you guidance on your investments. Here are five reasons why you should consider a financial planner. This professional can help guide you through the mazes of financial planning.

Personal financial planning involves several aspects, including retirement planning, estate planning, succession planning, and debt management. It includes budgeting, investment strategies, and budgeting. Your financial planner can help you set and reach your goals by reviewing your current financial status and helping you develop an investment plan tailored to your needs and goals.

FAQ

What is the difference between bookkeeping and accounting?

Accounting is the study of financial transactions. Bookkeeping is the recording of those transactions.

Both are connected, but they are distinct activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

Bookkeepers record financial information for purposes of reporting on the financial condition of an organization.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

If they are unsure, they might recommend changes in GAAP.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

What does an auditor do?

Auditors look for inconsistencies among the financial statements' information and the actual events.

He verifies the accuracy of all figures supplied by the company.

He also verifies that the company's financial statements are valid.

What exactly is bookkeeping?

Bookkeeping can be described as the keeping of records about financial transactions for individuals, businesses and organizations. It includes recording all business-related expenses and income.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They prepare tax returns, as well as other reports.

What are the benefits of accounting and bookkeeping?

Bookkeeping and accounting is essential for any business. They help you keep track of all your transactions and expenses.

They also help you ensure you're not spending too much money on unnecessary items.

Know how much profit you have made on each sale. Also, you will need to know how much debt you owe other people.

If you don’t have enough money, you might think about raising the prices. If you raise them too high, though, you might lose customers.

You may be able to sell some inventory if you have more than what you need.

You could reduce your spending if you have more than you need.

These things can have a negative impact on your bottom line.

What is a Certified Public Accountant, and what does it mean?

A C.P.A. is a certified public accountant. A person who is certified in public accounting (C.P.A.) has specialized knowledge in the field of accounting. He/she knows how to prepare tax returns and assist businesses in making sound business decisions.

He/She also keeps track of the company's cash flow and makes sure that the company is running smoothly.

What are the various types of bookkeeping systems available?

There are three main types of bookkeeping systems: manual, computerized and hybrid.

Manual bookkeeping refers to the use of pen & paper to record records. This method demands constant attention to detail.

Computerized bookkeeping uses software programs to manage finances. It is time- and labor-savings.

Hybrid Bookkeeping is a hybrid of manual and computerized methods.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

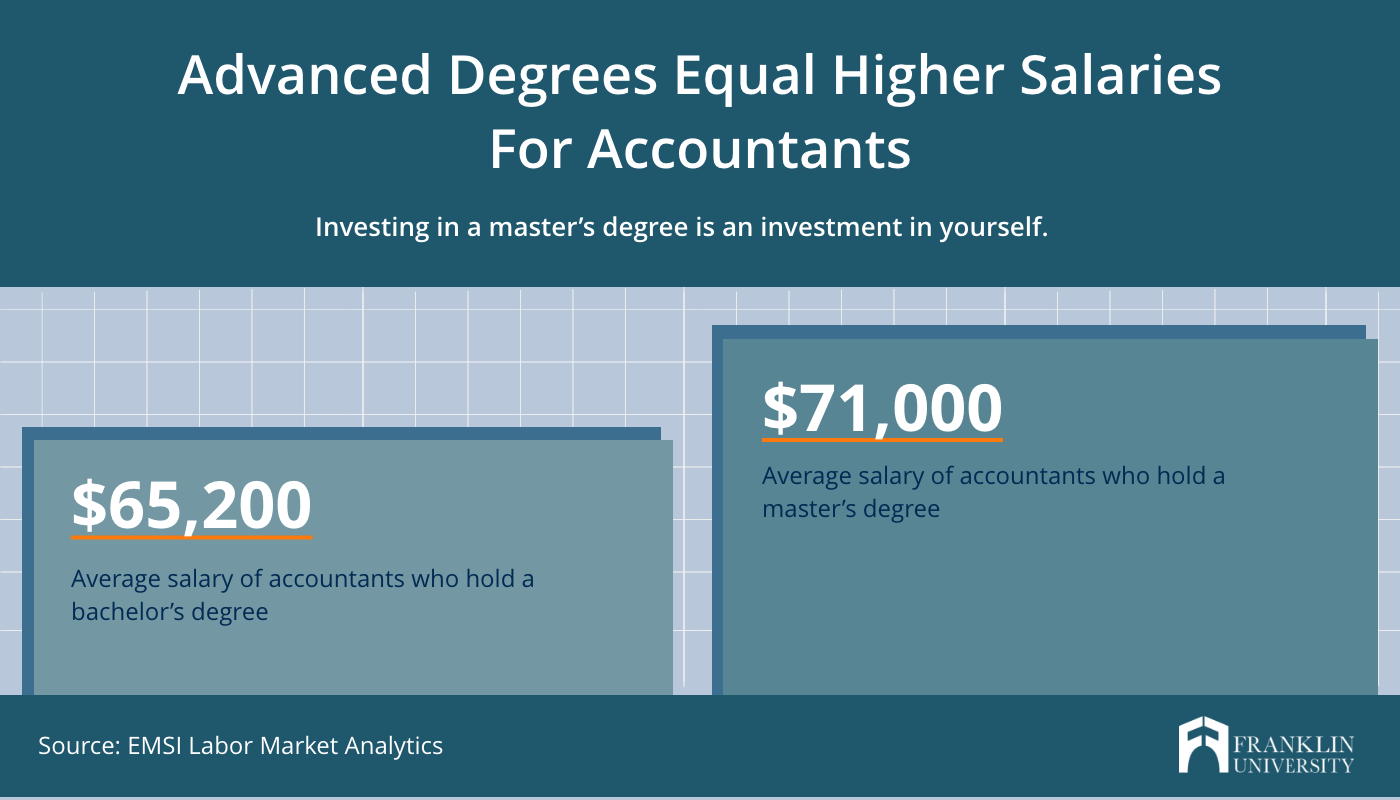

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

The Best Way To Do Accounting

Accounting is a collection of processes and procedures that businesses use to record and track transactions. Accounting involves recording income and expense, keeping track sales revenue and expenditures and preparing financial statements.

This includes reporting financial results to investors, shareholders, lenders, customers, and other stakeholders.

Accounting can take many forms. Some examples are:

-

Create spreadsheets manually

-

Excel can be used.

-

Handwriting notes on paper

-

Use computerized accounting systems.

-

Online accounting services.

There are many ways to do accounting. Each method has its own advantages and drawbacks. Which one you choose depends on your business model and needs. Before you decide on any one method, consider all the pros and disadvantages.

Accounting methods are not only more efficient, they can also be used for other reasons. Good books can prove your work if you are self-employed. Simple accounting is best for small businesses with little money. However, complex accounting may be more appropriate for businesses that generate large amounts of cash.