You can either start your financial career as a fund accountant or improve your current job. The benefits of this job include paid maternity leaves, vision insurance, health and life insurance, as well as a 401(k). Fund accounting can also be done remotely. A fund accountant could work for financial institutions, government agencies or hedge funds.

Whether you choose to work in an office setting or out of the office, it's important to learn how to manage your time efficiently. Fund accountants can work overtime during tax season due to pressure. It is important to learn how to communicate with other professionals within the office, via e-mails and letters.

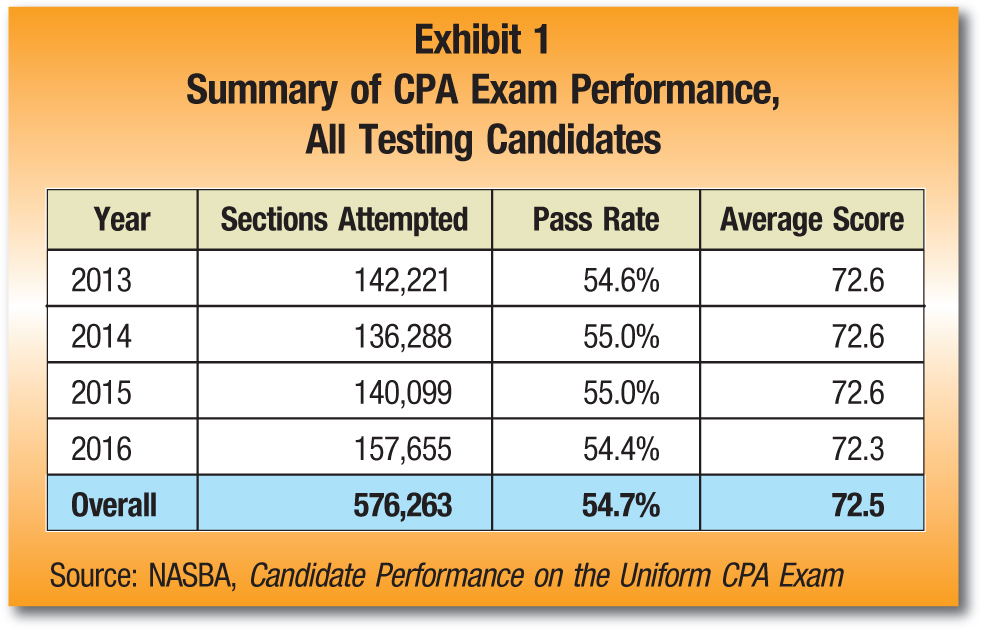

A fund accountant may also earn certifications for their work, including the CPA (Certified Public Accountant) or Certified Financial Planner (CFP). These certifications will benefit your career over the long term as they will help to you manage your finances. A bachelor's level in accounting may be sufficient to begin a career as an accountant. However, some employers may prefer a masters. A master's in accounting can prepare you for the CPA exams, which are required for this job.

Fund accounting is a promising career for those who love numbers. As a fund accountant, the job of ensuring that company funds are properly managed is a challenging one. This requires them to learn how to reconcile trades, prepare financial statements, and explain accounting techniques.

Fund accountants work in high demand. Many companies hire them on a part-time basis. A fund administration internship is a good option for recent graduates. This will help you determine if this career is for your. The pay is generally well rounded, and the average salary is around $45,000 to $62,000. Employer-paid benefits include vision and health insurance as well.

Fund accountants may be able to work alongside other fund managers, or with other departments within the company. It can be thrilling, but it's also important that you have organizational skills. You may need to coordinate with auditors, tax advisers, and other employees to meet deadlines. You may also find yourself working with several clients at a time, which can be a little distracting.

You may need to have a bachelor's in business or accounting to be able to work as a fund accountant. For accountants who are interested in a hands-on approach to learning more about fund accounting, there are a variety of certificate programs. You can even learn how to use accounting software in some programs.

You may also have the option to work as a fund accountant for a fund administration company. This will help you focus on mutual funds, private capital funds, and hedge funds. Fund management companies will require a more advanced degree than a fund accountant, but will also require that you have experience working with investment managers.

FAQ

What kind of training does it take to be a bookkeeper

Bookkeepers need basic math skills, such as addition, subtraction, multiplication, division, fractions, percentages, and simple algebra.

They also need to know how to use a computer.

Many bookkeepers are graduates of high school. Some have even earned college degrees.

What does an accountant do and why is it important?

An accountant keeps track on all the money you make and spend. They track how much you pay in taxes and what deductions you are allowed to make.

An accountant helps manage your finances by keeping track of your income and expenses.

They assist in the preparation of financial reports for both individuals and businesses.

Accounting professionals are required because they need to be able to understand all aspects of the numbers.

Additionally, accountants assist with tax filing and make sure that taxpayers pay the least amount of tax.

What is bookkeeping exactly?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It involves recording all business-related income as well as expenses.

Bookkeepers maintain financial records such as receipts. They also prepare tax returns as well other reports.

What is the difference between accounting and bookkeeping?

Accounting is the study of financial transactions. The recording of these transactions is called bookkeeping.

Both are connected, but they are distinct activities.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

Bookkeepers record financial information for purposes of reporting on the financial condition of an organization.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

They might recommend changes to GAAP, if not.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

What is the difference between a CPA (Chartered Accountant) and a CPA (Chartered Accountant)?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants are usually more experienced than CPAs.

Chartered accountants are also qualified to offer tax advice.

A chartered accountancy course takes 6-7 years to complete.

Are accountants paid?

Yes, accountants often get paid hourly.

Some accountants charge extra for preparing complicated financial statements.

Sometimes accountants will be hired to complete specific tasks. A public relations agency might hire an accountant to prepare reports showing the client's progress.

What should I do when hiring an accountant?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You want someone who's done this before and who knows the ropes.

Ask them for any specific skills or knowledge that they might have that you would find helpful.

Make sure they have a good name in the community.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

Accounting for Small Businesses: What to Do

Accounting is a critical part of running a small business. This involves tracking income and expenses as well as preparing financial reports and tax payments. This task also requires the use of software programs, such as Quickbooks Online. There are many ways you can go about doing your accounting for small businesses. You need to choose the most appropriate method for your business. We have listed the best options for you below.

-

Use the paper accounting system. Paper accounting is a good option if you prefer simplicity. The process of using this method is very easy; you just need to record your transactions daily. You might consider investing in an accounting software like QuickBooks Online if you want your records to be accurate and complete.

-

Online accounting is a great option. Online accounting is a way to have easy access to your accounts no matter where you are. Some popular options include Xero, Freshbooks, and Wave Systems. These software allows you to manage your finances and generate reports. They have many great features and are very easy to use. These programs are great for saving time and money in accounting.

-

Use cloud accounting. Another option is cloud accounting. It allows you to store your data securely on a remote server. Cloud accounting has many advantages when compared to traditional accounting software. First, it does not require you to buy expensive hardware or software. Because all your information is stored remotely, it provides better security. It takes the worry out of backups. Fourth, it makes it easier for you to share your files with other people.

-

Use bookkeeping software. Bookkeeping software is similar with cloud accounting. However you must purchase a computer in order to install the software. After the software has been installed, you can connect to your internet account to access them whenever you like. You will also have the ability to access your accounts and balances directly from your PC.

-

Use spreadsheets. Spreadsheets allow you to enter your financial transactions manually. To illustrate, you could create a spreadsheet in which you can record your sales figures daily. A spreadsheet has the advantage of being able to modify them whenever you wish without needing a complete update.

-

Use a cash book. A cashbook is a book that records every transaction you make. Cashbooks come with different sizes and shapes, depending on how many pages you have. You have the option of using a different notebook for each month, or a single notebook that covers several months.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. You can then add notes to help remember what you bought later.

-

Use a journal. A journal is a type of logbook that keeps track of your expenses. This is a good option if you have lots of recurring expenses like rent and insurance.

-

Use a diary. A diary is simply a journal that you write to yourself. It is useful for keeping track of your spending habits, and planning your budget.