You have reached the right place if your goal is to complete an online course to be an accountant. This article will provide information about the required requirements and course work to achieve an accounting certification. We will also discuss the possible salary and course requirements so you are ready to begin your new career in financial services. So, what exactly are accounting certifications? How much are they? Which one is right for me?

High school diploma or GED

Many people associate a diploma and high school with high school. However, while it is true that some situations require a college degree, a high school diploma suffices. Many people don't have the financial means to finance college. This is where online certificate courses come in. These programs make it possible for people to receive the training they require without getting into debt. An online accounting certificate can be obtained while you are at home.

GPA greater than 2.5

If you're looking to earn your accounting certification online, your grade point average is an important factor to consider. You might wonder what you can do to increase your chances of being admitted to an accounting program online if your high school GPA falls below 2.5. While you can certainly work harder to improve your grade point average, your best bet is to apply to scholarships without a minimum GPA requirement. Some scholarships require a minimum GPA requirement of 2.5.

An applicant to an online program should have a minimum 2.5 GPA. Even though this is more challenging in junior years, it is well worth it. Even a B can lead to an A. This is a great step toward junior class status. The applicant can also increase their GPA to 2.5 or 2.7, opening up more possibilities.

Required Coursework

You may want to get an accounting certificate for many reasons. This certificate can be a fantastic way to grow your career. In addition to proving your graduate knowledge, an online certificate can help you reach your promotion goals or advance your career into a new area. We'll be discussing a few reasons to get an online accounting certification. These credentials will show that you are able to work in a more challenging job and keep up with the latest technologies.

First, a certificate course teaches the fundamentals and use of accounting software. It can also help to build a foundation in management accounting. Some online certificate programs teach you about cost accounting from a leadership perspective, as well as standard costs and budgets. A master's degree in accounting may be a good option if you have a passion. However, a certificate program doesn't guarantee you a job. If you aren't sure which program to choose, make sure it has regional accreditation.

Salary

An online accounting certification can give you valuable skills that will help you in a variety career fields. Earning your certification online can help you excel whether you're already working in an accounting environment or are looking for a new career. With a certificate in hand, you will be better equipped to secure a higher-paying position. The best online certification programs will help build the skills required by companies of any size, from Fortune 500 to small businesses.

Many online certificate programs offer basic accounting principles and practices. Although they don't include algebra, this is a common requirement. You might consider including college algebra in your course selections if it is not something you already take. You'll also learn about cost accounting and corporate finance, which can be extremely useful in your future career as an accountant. The final step is to learn how you can create a budget, and prepare prices.

FAQ

What does it mean to reconcile accounts?

A reconciliation is the comparison of two sets. One set is called the "source," and the other is called the "reconciled."

The source contains actual figures. While the reconciled indicates the figure that should not be used,

You could, for example, subtract $50 from $100 if you owe $100 to someone.

This process ensures that there aren't any errors in the accounting system.

What should I look for in an accountant's hiring decision?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You want someone who's done this before and who knows the ropes.

Ask them for any specific skills or knowledge that they might have that you would find helpful.

Make sure they have a good reputation in the community.

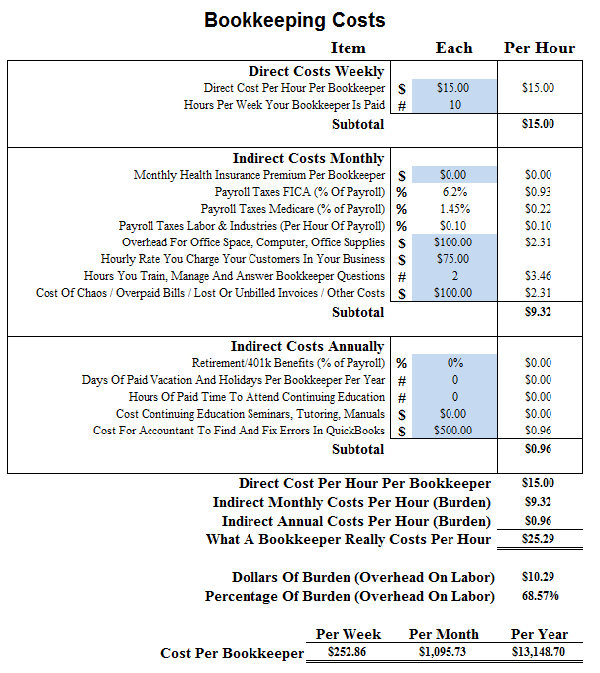

What's the difference between accounting & bookkeeping?

Accounting is the study and analysis of financial transactions. Bookkeeping is the recording of those transactions.

These are two related activities, but separate.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They adjust entries in accounts payable, receivable, and payroll to ensure that all books are balanced.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

They may suggest changes to GAAP if they do not agree.

Accounting professionals can use the financial transactions that bookkeepers have kept to analyze them.

Are accountants paid?

Yes, accountants usually get paid hourly rates.

Complicated financial statements can be a charge for some accountants.

Sometimes, accountants are hired for specific tasks. An accountant might be hired by a public relations company to create a report that shows how their client is doing.

What is an accountant's role and why does it matter?

An accountant keeps track and records all the money you spend and earn. They keep track of how much tax is paid and allowable deductions.

An accountant helps manage your finances by keeping track of your income and expenses.

They are responsible for preparing financial reports that can be used by individuals or businesses.

Accountants are necessary because they must be knowledgeable about all things numbers.

A professional accountant can also help with taxes, so that people pay as little tax as they possibly can.

Statistics

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

Accounting for Small Business: What is the best way to do it?

Accounting is an essential part of managing any business. Accounting includes the preparation of financial reports and income statements, as well tracking expenses and income. Quickbooks Online and other software programs are required. There are many different ways you can do your small business accounting. You must choose the right method for you, based on your requirements. Below is a list of top methods that we recommend.

-

The paper accounting method is recommended. If you want to keep things simple, then using paper accounting may work well for you. The process of using this method is very easy; you just need to record your transactions daily. An accounting program such as QuickBooks Online can help you ensure your records are accurate.

-

Online accounting is a great option. Online accounting makes it easy to access your accounts anywhere, anytime. Wave Systems, Freshbooks, Xero, and Freshbooks are just a few of the popular options. These software allows you to manage your finances and generate reports. These programs offer many features and benefits. They also make it easy to use. These programs will help you save both time and money in accounting.

-

Use cloud accounting. Cloud accounting is another option that you could use. It allows you secure storage of your data on a remote server. Cloud accounting has many advantages when compared to traditional accounting software. It doesn't require you to purchase expensive hardware or software. It offers greater security as all of your data is stored remotely. It saves you the hassle of backing up your data. Fourth, it makes it easier for you to share your files with other people.

-

Use bookkeeping software. Bookkeeping software can be used in the same manner as cloud accounting. But, it is necessary to purchase a new computer and install it. After you install the software, you'll be able connect to the internet and access your accounts whenever you wish. In addition, you will be able to view your accounts and balance sheets directly through your PC.

-

Use spreadsheets. Spreadsheets can be used to manually enter financial transactions. You can, for example, create a spreadsheet that allows you to enter sales figures each day. A spreadsheet's advantage is that you can make changes to them at any time without having to change the whole document.

-

Use a cash book. A cashbook is a book that records every transaction you make. Cashbooks can come in different sizes depending on how much space is available. You can either use a separate notebook for each month or use a single notebook that spans multiple months.

-

Use a check register. Use a check register to keep track of receipts and pay bills. Once you have scanned the items, you can transfer them into your check register. Notes can be added to the items once they are scanned.

-

Use a journal. A journal is a logbook which keeps track of your expenses. If you have many recurring expenses, such as rent, insurance, or utilities, this journal is the best.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it for tracking your spending habits or planning your budget.